All Categories

Featured

Table of Contents

- – Favored Private Equity For Accredited Investors

- – Superior Accredited Investor Investment Returns

- – Reliable Accredited Investor Investment Networks

- – Exclusive Accredited Investor Platforms for A...

- – High-Growth Accredited Investor Real Estate ...

- – First-Class Accredited Investor Investment R...

- – World-Class Accredited Investor Opportunitie...

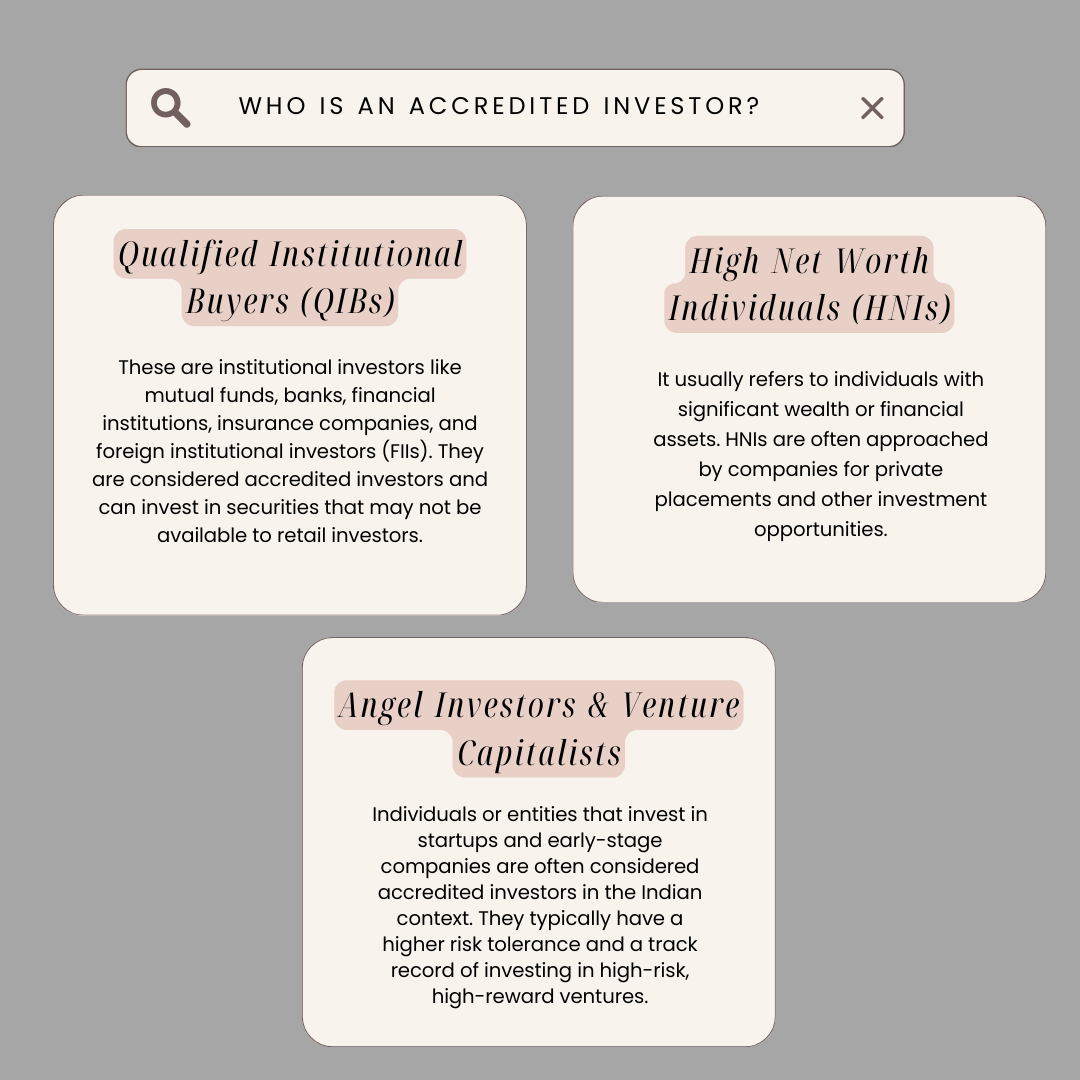

The guidelines for accredited financiers differ amongst territories. In the U.S, the meaning of an approved financier is presented by the SEC in Guideline 501 of Law D. To be a recognized financier, a person must have a yearly revenue exceeding $200,000 ($300,000 for joint revenue) for the last 2 years with the expectation of making the exact same or a greater revenue in the current year.

A certified capitalist must have a net well worth surpassing $1 million, either separately or collectively with a partner. This quantity can not consist of a key house. The SEC likewise considers candidates to be approved investors if they are general companions, executive police officers, or supervisors of a company that is releasing unregistered safety and securities.

Favored Private Equity For Accredited Investors

If an entity is composed of equity owners who are accredited investors, the entity itself is an accredited financier. A company can not be created with the single function of purchasing particular securities. A person can qualify as an accredited financier by showing adequate education and learning or job experience in the financial sector

Individuals that wish to be recognized investors don't put on the SEC for the classification. Rather, it is the duty of the firm using a private placement to make certain that all of those approached are accredited capitalists. People or events that intend to be accredited financiers can come close to the provider of the non listed securities.

Mean there is a specific whose revenue was $150,000 for the last three years. They reported a key residence value of $1 million (with a mortgage of $200,000), a vehicle worth $100,000 (with an outstanding finance of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

This person's web worth is specifically $1 million. Considering that they meet the internet worth need, they certify to be an accredited investor.

Superior Accredited Investor Investment Returns

There are a couple of less common qualifications, such as managing a trust fund with even more than $5 million in properties. Under federal securities laws, only those that are certified investors might take part in certain safety and securities offerings. These may consist of shares in personal positionings, structured items, and personal equity or bush funds, amongst others.

The regulatory authorities intend to be particular that individuals in these very high-risk and complex financial investments can fend for themselves and judge the threats in the absence of government defense. The accredited investor regulations are created to safeguard prospective capitalists with restricted monetary expertise from adventures and losses they may be unwell equipped to hold up against.

Recognized financiers satisfy qualifications and expert standards to accessibility exclusive financial investment opportunities. Designated by the United State Securities and Exchange Payment (SEC), they obtain entrance to high-return options such as hedge funds, financial backing, and exclusive equity. These financial investments bypass complete SEC registration yet carry greater threats. Certified financiers should fulfill earnings and internet well worth demands, unlike non-accredited people, and can spend without constraints.

Reliable Accredited Investor Investment Networks

Some crucial modifications made in 2020 by the SEC consist of:. This adjustment recognizes that these entity types are usually utilized for making investments.

These changes broaden the recognized financier pool by around 64 million Americans. This broader accessibility provides extra opportunities for investors, however likewise increases possible threats as much less monetarily innovative, financiers can get involved.

One major benefit is the opportunity to buy placements and hedge funds. These investment choices are unique to recognized capitalists and establishments that qualify as a recognized, per SEC laws. Exclusive positionings enable firms to protect funds without navigating the IPO procedure and regulatory documents required for offerings. This provides recognized capitalists the possibility to spend in emerging firms at a phase prior to they consider going public.

Exclusive Accredited Investor Platforms for Accredited Investors

They are deemed financial investments and are easily accessible just, to certified clients. Along with known firms, qualified capitalists can pick to buy startups and up-and-coming endeavors. This supplies them tax obligation returns and the possibility to enter at an earlier phase and potentially enjoy rewards if the firm thrives.

However, for financiers open to the dangers involved, backing startups can cause gains. A lot of today's technology firms such as Facebook, Uber and Airbnb originated as early-stage start-ups sustained by certified angel investors. Sophisticated capitalists have the chance to explore financial investment alternatives that might generate much more earnings than what public markets provide

High-Growth Accredited Investor Real Estate Deals for Expanding Investment Opportunities

Returns are not guaranteed, diversification and portfolio improvement choices are increased for financiers. By expanding their portfolios via these expanded financial investment avenues recognized investors can improve their techniques and potentially achieve remarkable lasting returns with correct danger monitoring. Experienced investors frequently experience financial investment alternatives that may not be quickly offered to the basic financier.

Financial investment options and safety and securities used to approved investors normally involve higher threats. As an example, exclusive equity, venture resources and hedge funds usually concentrate on purchasing assets that bring risk but can be sold off easily for the possibility of higher returns on those dangerous financial investments. Investigating prior to spending is essential these in circumstances.

Lock up periods avoid capitalists from withdrawing funds for more months and years on end. Investors might struggle to properly value private possessions.

First-Class Accredited Investor Investment Returns for High Returns

This change may extend recognized capitalist standing to a range of people. Allowing companions in committed partnerships to combine their sources for common eligibility as accredited investors.

Making it possible for individuals with specific specialist accreditations, such as Series 7 or CFA, to certify as certified capitalists. This would certainly identify financial class. Producing additional demands such as evidence of monetary literacy or efficiently finishing an approved investor examination. This could make certain investors comprehend the risks. Limiting or eliminating the key house from the total assets estimation to reduce potentially inflated analyses of wide range.

On the various other hand, it might additionally result in skilled financiers presuming extreme risks that may not be appropriate for them. Existing recognized capitalists might deal with raised competitors for the ideal financial investment opportunities if the pool grows.

World-Class Accredited Investor Opportunities for Accredited Investor Opportunities

Those that are currently taken into consideration recognized investors need to remain updated on any type of changes to the standards and guidelines. Their qualification might be subject to modifications in the future. To maintain their standing as accredited investors under a changed meaning adjustments may be required in riches administration methods. Businesses seeking recognized investors ought to remain attentive about these updates to guarantee they are drawing in the right audience of financiers.

Table of Contents

- – Favored Private Equity For Accredited Investors

- – Superior Accredited Investor Investment Returns

- – Reliable Accredited Investor Investment Networks

- – Exclusive Accredited Investor Platforms for A...

- – High-Growth Accredited Investor Real Estate ...

- – First-Class Accredited Investor Investment R...

- – World-Class Accredited Investor Opportunitie...

Latest Posts

Sec Verification Of Accredited Investor Status

Market-Leading County Tax Sale Overage List Course Bob Diamond Tax Overages Blueprint

Dependable Tax Auction Overages System Bob Diamond Tax Overages Blueprint

More

Latest Posts

Sec Verification Of Accredited Investor Status

Market-Leading County Tax Sale Overage List Course Bob Diamond Tax Overages Blueprint

Dependable Tax Auction Overages System Bob Diamond Tax Overages Blueprint