All Categories

Featured

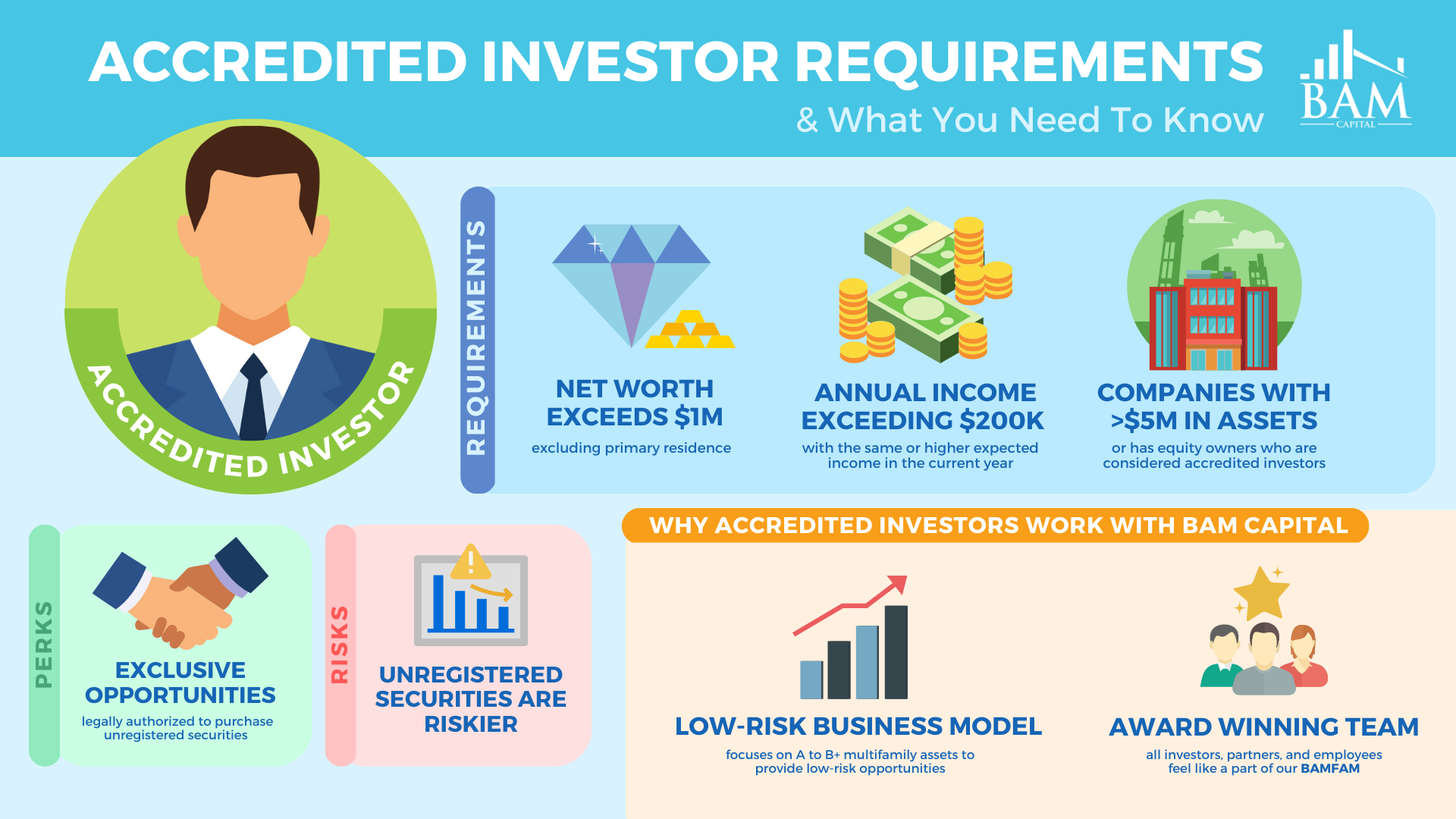

In 2020, an approximated 13.6 million united state houses are recognized financiers. These families regulate massive wide range, approximated at over $73 trillion, which represents over 76% of all personal wealth in the united state. These financiers take part in investment opportunities usually not available to non-accredited investors, such as financial investments in exclusive business and offerings by particular hedge funds, personal equity funds, and equity capital funds, which allow them to expand their wide range.

Read on for details regarding the most current recognized investor modifications. Financial institutions generally money the majority, but hardly ever all, of the funding needed of any kind of purchase.

There are largely 2 regulations that enable companies of safeties to use limitless amounts of safety and securities to financiers. qualification of investors. One of them is Rule 506(b) of Law D, which enables a provider to market securities to endless accredited capitalists and as much as 35 Innovative Investors just if the offering is NOT made via basic solicitation and general advertising

The recently taken on changes for the very first time accredit individual capitalists based on monetary sophistication demands. The changes to the certified capitalist definition in Guideline 501(a): consist of as accredited financiers any type of trust, with overall possessions a lot more than $5 million, not formed particularly to buy the subject protections, whose purchase is directed by an innovative individual, or include as recognized financiers any entity in which all the equity owners are accredited capitalists.

Under the government safety and securities legislations, a company might not supply or market safety and securities to investors without enrollment with the SEC. There are a number of enrollment exceptions that inevitably broaden the universe of potential capitalists. Lots of exceptions require that the investment offering be made just to persons who are recognized capitalists.

Furthermore, accredited financiers frequently receive more desirable terms and higher prospective returns than what is offered to the public. This is since personal placements and hedge funds are not called for to abide by the very same regulatory demands as public offerings, allowing for more versatility in regards to financial investment approaches and potential returns.

Accredited Investor Requirements Usa

One factor these safety offerings are limited to certified financiers is to guarantee that all taking part financiers are financially advanced and able to fend for themselves or sustain the danger of loss, therefore rendering unnecessary the securities that come from an authorized offering.

The web worth test is relatively straightforward. Either you have a million bucks, or you do not. However, on the revenue test, the person has to satisfy the thresholds for the 3 years consistently either alone or with a partner, and can not, for instance, satisfy one year based upon private revenue and the following two years based upon joint earnings with a spouse.

Latest Posts

Sec Verification Of Accredited Investor Status

Market-Leading County Tax Sale Overage List Course Bob Diamond Tax Overages Blueprint

Dependable Tax Auction Overages System Bob Diamond Tax Overages Blueprint

More

Latest Posts

Sec Verification Of Accredited Investor Status

Market-Leading County Tax Sale Overage List Course Bob Diamond Tax Overages Blueprint

Dependable Tax Auction Overages System Bob Diamond Tax Overages Blueprint